Global third‑party banking software market solutions reached USD 30.9 billion in 2024, and are poised to surge to USD 57.6 billion by 2033, growing at a 6.8 % CAGR. These platforms offer integrated core banking, private wealth management, business intelligence, and omnichannel capabilities. Financial institutions are embracing them to boost operational flexibility, reduce human errors, enhance customer engagement, and secure a competitive advantage - all while riding the wave of expanding digital banking and data-driven strategies.

Study Assumption Years

- Base Year: 2024

- Historical Year: 2019–2024

- Forecast Year: 2025–2033

Third-Party Banking Software Market Key Takeaways

- Market valued at USD 30.9 B by 2024, expected to reach USD 57.6 B by 2033, expanding at 6.8 % CAGR.

- Cloud deployment adoption is rising faster than on-premises solutions.

- Business intelligence and risk management applications are seeing strong uptake as banks rely more on analytics.

- Commercial banks and retail/trading banks are the primary adopters, with commercial banks growing rapidly.

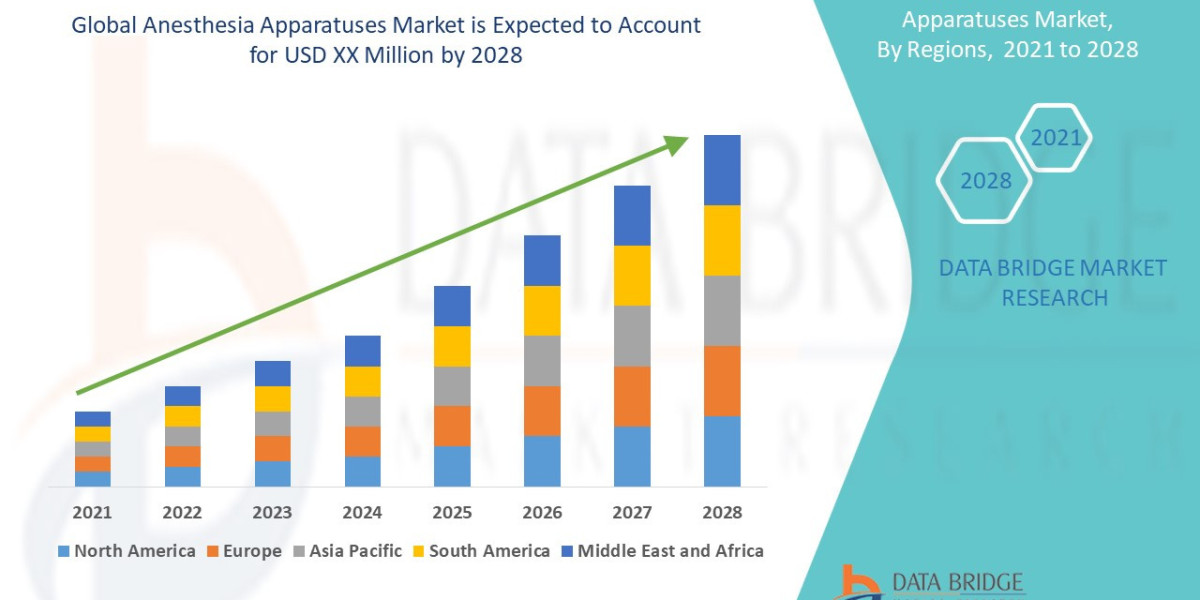

- North America leads market share, while Asia Pacific shows fastest growth due to modernizing IT and a regulatory push.

Market Growth Factors

1. How Businesses Are Adopting Digital Transformation with Streamlined Tech Solutions?

The BFSI sector is going through a fast-paced digital evolution, which is ramping up the demand for third-party software that optimizes everything from core banking and risk management to ensuring smooth customer service across various channels. Banks are shifting to cloud-based systems to enhance scalability and trim down operating costs. The rise of big data analytics is empowering these institutions to sift through large volumes of customer and transaction data, extract meaningful insights, and make quick decisions, which further supports the adoption of these platforms. Plus, innovative tools like AI-driven analytics are boosting fraud detection and personalizing user experiences, which is propelling market growth even further.

2. How Cloud Compliance Standards and Secure APIs Are Shaping the Future of Digital Infrastructure?

With strict rules governing data protection, risk management, and compliance, banks are increasingly relying on specialized vendor solutions. These third-party software options for risk management and information security facilitate real-time monitoring of any discrepancies, helping them maintain compliance. The rise of cloud compliance frameworks and secure APIs has accelerated this trend, enabling vendors to rapidly adapt their solutions to meet shifting standards. As regulations continue to evolve, the appetite for modular, compliance-ready software is only growing.

3. Empowering Businesses Through Next-Gen Transaction Infrastructure

Banks are really focusing on putting customers first these days, which means they need to have modern systems in place for seamless transactions, whether you're banking on your phone, online, or in person. Third-party platforms are stepping up their game with omnichannel features that not only enhance engagement but also help reduce errors. As digital payment options become more popular and partnerships with fintech companies expand, there's a growing need for integrated platforms that support real-time banking, streamline manual processes, and boost overall efficiency. This trend is especially noticeable in areas where mobile usage is high and customers are tech-savvy.

Request for a sample copy of this report:

https://www.imarcgroup.com/third-party-banking-software-market/requestsample

Market Segmentation

Breakup by Product

- Core Banking Software: Central systems handling transactions, accounts, etc.

- Multi-Channel Banking Software: Omnichannel access across web, mobile, branch.

- Business Intelligence Software: Analytics-driven insights for strategic decisions.

- Others: Specialized modules beyond core, channel, and BI systems.

Breakup by Deployment Type

- On‑premises

- Cloud‑based

Breakup by Application

- Risk Management

- Information Security

- Business Intelligence

- Others

Breakup by End‑User

- Commercial Banks

- Retail and Trading Banks

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

North America emerged as the dominant region in 2024, driven by its mature fintech ecosystem, high digital banking penetration, and major software vendors. The U.S. and Canada lead technological integration across banks, with elevated adoption of cloud-based and analytics-enabled platforms. At the same time, Asia Pacific is the fastest-growing region due to IT modernization in China, India, Japan, government tech initiatives, and rising demand for digital financial services.

Recent Developments & News

Banks are increasingly partnering with fintech and third-party vendors to offer enhanced risk management and omnichannel experiences. Integration of big data and AI-based analytics is becoming standard, enabling predictive insights and real-time decision-making. Cloud-native implementations are replacing legacy systems, ensuring faster deployments and improved scalability. Mobile-first strategies are gaining momentum, meeting customer expectations for anytime, anywhere banking. These innovations reflect a continued emphasis on speed, efficiency, and digitally native service delivery.

Key Players

Accenture, Capgemini, Deltek, IBM, Infosys, Microsoft Corporation, NetSuite Inc., Oracle Corporation, SAP SE, and Tata Consultancy Services

Ask Analyst for Customization:

https://www.imarcgroup.com/request?type=report&id=2121&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145