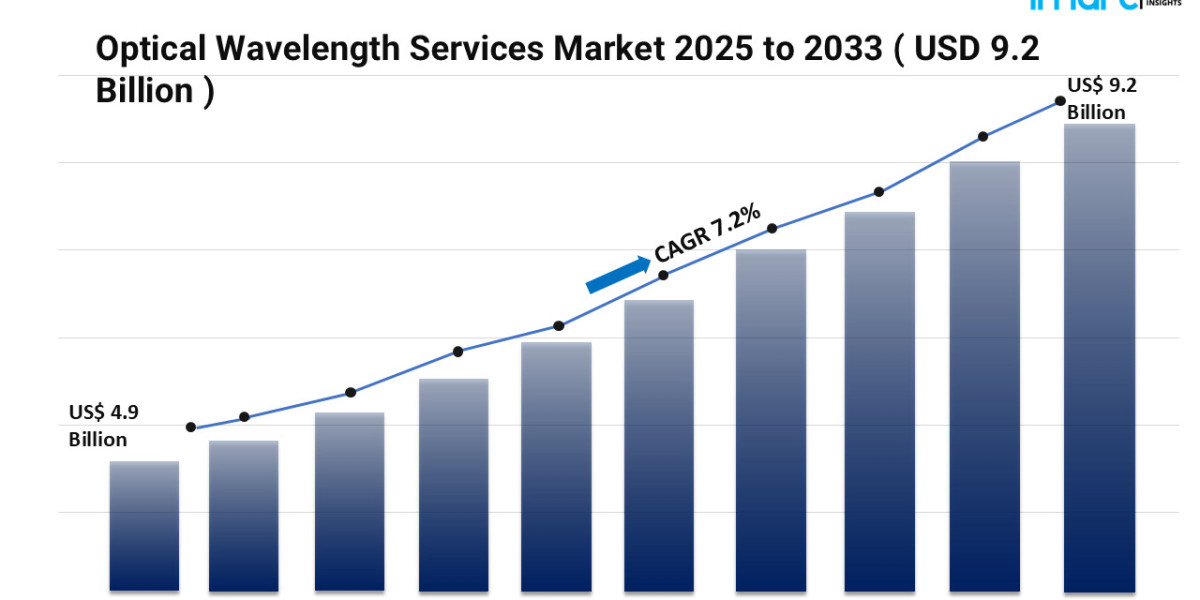

The global Optical Wavelength Services market size is projected to grow from USD 4.9 billion in 2024 to USD 9.2 billion by 2033, at a CAGR of 7.2%. Fueled by surging demand from hyperscale data centers, 5G rollouts, and expanding cloud infrastructure, this market’s expansion is underpinned by investments in WDM advancements, fiber network buildout, and regulatory support, positioning it for robust growth into the next decade.

For More Information Watch This Video: Optical Wavelength Services Market Size and Report 2025-33

Study Assumption Years

- Base Year: 2024

- Historical Year: 2019–2024

- Forecast Years: 2025–2033

Optical Wavelength Services Market Key Takeaways

- Market Size & Growth: Forecast to grow from USD 4.9 B to USD 9.2 B by 2033 at a 7.2% CAGR.

- Regional Leader: North America commands over 35% share, driven by fiber infrastructure and hyperscale demand.

- Bandwidth Segment: “Less than 10 Gbps” holds 48.2% share, favored by businesses and telecoms.

- Interface Segment: Ethernet leads with ~41.2%, due to scalability and cost-efficiency.

- Organization Size: Large enterprises dominate with 76.5%, owing to data center and cloud interconnect needs.

- Application Segment: Short-haul services lead at ~41.4%, supporting metro, edge, and data center links.

Market Growth Factors

1 - From 100G to 800G: How Next-Gen Optical Wavelengths Are Shaping the Future of Connectivity?

The rapid migration from 100G to 400G - and even toward 800G and terabit-capable services - is transforming network capabilities. Coherent optics, flexible-grid WDM, and WaveLogic innovations (like Ciena’s 400 Gbps systems in Europe) not only boost bandwidth but also enhance spectral efficiency and reduce cost-per-bit. This tech evolution directly supports the massive data demands from AI, big data, and edge computing, enabling operators to meet future connectivity needs with greater performance, lower latency, and enhanced scalability. As new protocols evolve, upgraded wavelength division multiplexing systems make network augmentation smoother than ever.

2 - How Cloud Adoption and IoT Are Shaping the Future of Data Traffic?

Global IP data traffic reached approximately 149 ZB in 2024 - a staggering volume yet to be surpassed. Growth drivers include cloud adoption, video streaming, IoT, and enterprise digitalization. Simultaneously, 5G rollouts require robust fiber backhaul infrastructure to support low-latency, high-bandwidth services, particularly in financial services and healthcare. This demand propels organizations and telcos to invest in dedicated wavelength services, essential for secure, scalable, and reliable connectivity.

3 - How Global Fiber Expansion Is Shaping the Future of Connectivity?

Global investments in fiber expansions - submarine, metro, and long-haul - and edge data center deployments are fueling this market. Fujitsu’s 1FINITY Ultra Optical System offering 1.2 Tbps per wavelength is a prime example. Edge computing growth drives needs for low-latency, high-throughput connectivity; wavelength services become pivotal in connecting edge nodes with core networks. Regulatory incentives, public-private infrastructure projects, and smart city rollouts also accelerate fiber buildouts, creating strong regional growth opportunities in underserved and emerging markets.

Request for a sample copy of this report:

https://www.imarcgroup.com/optical-wavelength-services-market/requestsample

Market Segmentation

Each segmentation below mirrors the IMARC report format:

By Bandwidth:

- Less than 10 Gbps

- 40 Gbps

- 100 Gbps

- More than 100 Gbps

By Interface:

- OTN

- Sonet

- Ethernet

By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

By Application:

- Short Haul

- Metro

- Long Haul

Breakup by Region:

- North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Regional Insights

North America, led by the U.S. (86.5% of regional share), dominates with over 35% of the global market. This leadership stems from robust fiber infrastructure, hyperscale data center expansion (515 MW added in H1 2024), 5G deployment, cloud adoption, and government-backed broadband initiatives like BEAD. Telcos (AT&T, Verizon) and data center operators fuel the shift toward 400G and 800G-capable networks.

Recent Developments & News

The market is witnessing impressive innovation:

- Nov 2024: Colt and Ciena achieved the first 1.2 Tb/s transatlantic wavelength trial with WaveLogic 6 Extreme, doubling capacity while halving power consumption.

- Oct 2024: Nokia, Windstream, and Colt trialed 800GbE over 8,500 km across the Atlantic using Nokia’s PSE‑6s coherent optics.

- Sept 2024: Nokia signed a multi-year agreement with AT&T to upgrade fiber infrastructure to 27.8 M locations.

- Aug 2024: Nokia enhanced DWDM networks for Malaysia, Thailand, and Singapore with PSE‑Vs technology to boost latency and capacity.

- Apr 2024: T‑Mobile and EQT partnered to acquire Lumos’s 7,500‑mile fiber system, expanding wholesale wavelength capacity.

Key Players

- AT&T Inc.

- CarrierBid Communications

- Charter Communications Inc.

- Colt Technology Services Group Limited

- Comcast Corporation

- Cox Communications Inc.

- Crown Castle

- GTT Communications Inc.

- Nokia Corporation

- T Mobile USA Inc. (Deutsche Telekom AG)

- Verizon Communications Inc.

- Windstream Holdings Inc.

- Zayo Group Holdings Inc.

Ask Analyst for Customization:

https://www.imarcgroup.com/request?type=report&id=4881&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145