IMARC Group, a leading market research company, has recently released a report titled "Electrical Steel Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global electrical steel market Trends, size, share, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Electrical Steel Market Highlights:

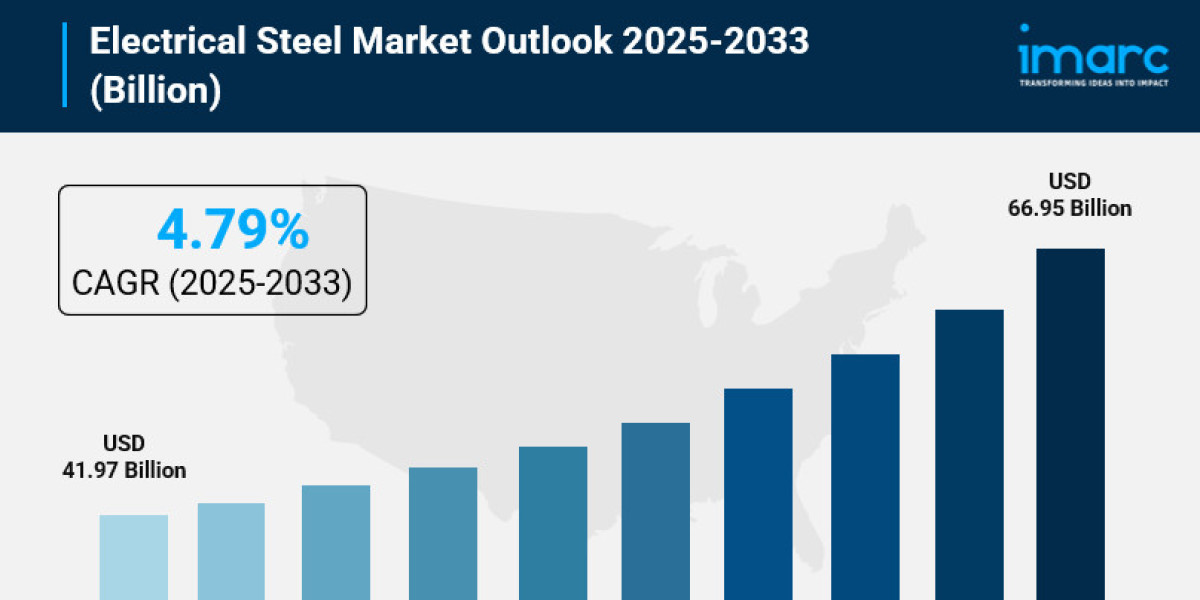

- Electrical Steel Market Size: Valued at USD 41.97 Billion in 2024.

- Electrical Steel Market Forecast: The market is expected to reach USD 66.95 billion by 2033, growing at an impressive rate of 4.79% annually.

- Market Growth: The electrical steel market is experiencing significant growth due to rising demand in the automotive and renewable energy sectors.

- Key Applications: Major applications include transformers, electric motors, and generators, primarily in industries such as automotive, energy, and manufacturing.

- Regional Insights: Asia-Pacific dominates the market, with China leading in production and consumption of electrical steel.

- Technological Advancements: Innovations in manufacturing processes and materials are enhancing the efficiency and performance of electrical steel.

- Market Challenges: Fluctuating raw material prices and environmental regulations pose challenges to market growth.

- Competitive Landscape: The market features key players like ArcelorMittal, Thyssenkrupp AG, and JFE Steel Corporation, focusing on strategic partnerships and expansions.

- Sustainability Trends: Increasing emphasis on sustainable manufacturing practices is influencing the market dynamics.

Claim Your Free “Electrical Steel Market” Insights Sample PDF: https://www.imarcgroup.com/electrical-steel-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Accelerated Demand from Electric Vehicle (EV) Traction Motors:

The main factor driving the growth of the NGOES market is the trend of global electrification of transport. The traction motors for electric vehicles (EVs) need magnetic materials to function at high rotational speeds and high frequencies with low core loss to improve the driving range and efficiency of EVs. This is creating a need for thin gauge high grade NGOES (thinner than 0.30 mm) which has higher permeability and lower eddy current losses. With major vehicle markets like China, the United States and the European Union planning to phase out production of internal combustion engine vehicles (ICEV) there is anticipated to be an exponential change in consumption of NGOES as electric cars, hybrid electric cars (HEV) and charging stations increase. The industrial demand on this scale has prompted steelmakers to invest in new specialized capacities for rolling, annealing and coating, technically aligned to the performance and volumes required by the automotive supply chain.

- Stringent Global Energy Efficiency Regulations for Transformers:

A stable driver for the GOES market is the increasing stringency of mandatory and voluntary energy efficiency regulations and standards for power and distribution transformers worldwide. US DOE and other national and international regulators such as the European Commission periodically update MEPS for electrical transformers to reduce the loss of energy in the electricity grid. Since the transformer core is responsible for a large percentage of overall energy loss, much higher grade High-Permeability (Hi-B) GOES steel is used to increase transformer efficiency. Hi-B steel has an extremely aligned grain size structure that greatly reduces energy loss in the magnetic core of transformers. A continuous drive to increase efficiency, in combination with the global replacement of obsolete transmission and distribution infrastructure (often with "smart" transformers), ensures the continual demand for the highest GOES grades.

- Proliferation of Renewable Energy and Distributed Generation:

Renewable power generation, especially variable renewable energy generation such as solar energy and wind energy, is driving a shift from large centralized fossil fuel power generating facilities to smaller distributed generating plants and thus increasing the requirement for specialty electrical steel in solar inverters, wind turbine generators, and small distribution transformers for microgrids and home use. Many of these decentralized applications require special steel grades, with modern inverters operating at the high frequency (higher than 1 kHz) requiring more thin NGOES to reduce losses, as well as the need for highly compact, high flux density steels, to fit into compact power electronics. Electrical steels are also used in renewable power electronics. They use amorphous metal and advanced ferrite cores for specialized inductors and low loss transformers. These applications are challenging because of distributed configurations, which cause the electrical steel market to deviate from customary grades and to focus on custom-engineered materials optimized for the load and frequency conditions typical of renewable energy systems.

Electrical Steel Market Report Segmentation:

Breakup By Type:

- Grain-Oriented Electrical Steel

- Non-Grain Oriented Electrical Steel

Breakup by Application:

- Transformers

- Motors

- Generators

- Others

Breakup by End Use Industry:

- Energy and Power

- Automobiles

- Household Appliances

- Building and Construction

- Others

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Aperam

- ArcelorMittal

- Baoshan Iron & Steel Co. Ltd. (China Baowu Steel Group Corp. Ltd.)

- China Steel Corporation

- JFE Holdings Inc.

- JSW Steel Ltd.

- Nippon Steel Corporation

- POSCO

- SIJ - Slovenian Steel Group d. d.

- Steel Authority of India Limited

- Sumitomo Corporation

- Tata Steel Limited

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine AG

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4637&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302